Enhance deposit and stablecoin offerings with the benefit of life insurance

Attract and retain customers with embedded life protection — no underwriting, opt-ins, or extra sign-ups.

schedule a call

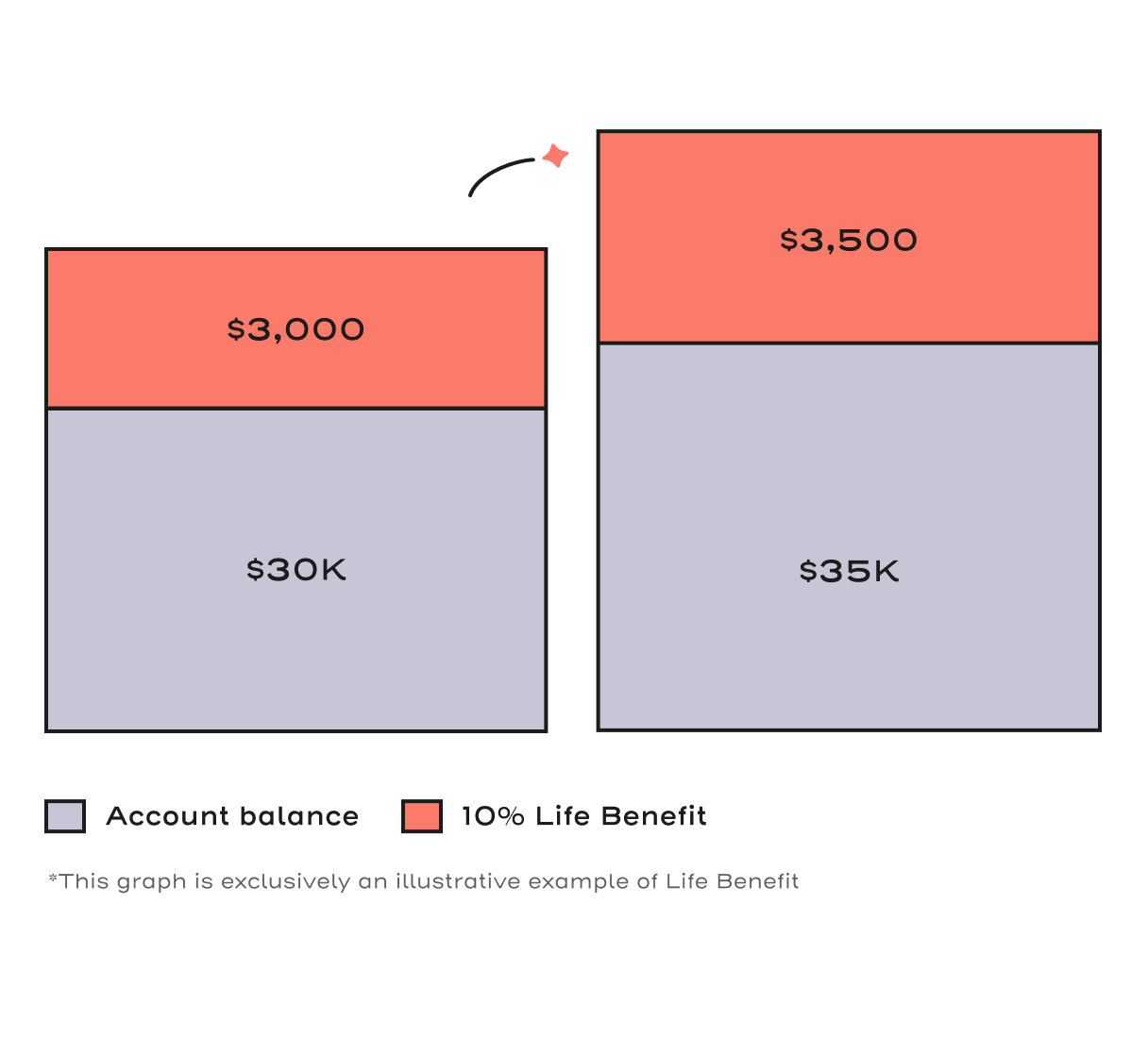

As account balances grow, so does their protection

Life Benefit links life insurance coverage directly to account value — across deposits and stablecoins alike — encouraging customers to grow and stay with you.

Life Benefit is driving real results for our partners

Within 6 months, partners see measurable growth after adding Life Benefit — from increased deposits to stronger retention. Discover what’s possible when protection meets purpose.

For ISB, this kind of protection isn’t just a financial tool—it’s peace of mind. Knowing our customers have something in place, even if it’s modest, makes a difference for families and future planning. It gives our customers another reason to stay and even grow their balances. That’s a win for everyone.

Adding Life Benefit is fast & easy

Life Benefit isn’t just a product — it’s a program

As a partner, we equip you with the tools, training, and support you need to succeed and get the most out of Life Benefit.

Unlock additional non-interest fee income

Tap into the market of nearly $4 billion of annual term life premiums3 by cross-selling Wysh’s term life insurance. Earn highly competitive commissions and help your customers get more protection for their loved ones.

Extend real-world protection to digital value

Bring the protection and trust of Life Benefit to stablecoin accounts — combining blockchain efficiency with life insurance protection.

Check out our FAQs

Life Benefit is a financial-protection benefit that financial institutions can purchase and embed into deposit or stablecoin accounts offered to their customers.

No. Wysh is the licensed carrier. Your company simply purchases the product so you can offer Life Benefit without needing an license.

Implementation is easy and straightforward, with most partners going live in 4-6 weeks. We handle any light code work with your team and offer marketing support to drive adoption.

Coverage is flexible. Most partners set a cap of up to $20k per customer, then pick a model that fits their strategy—percentage of balance, dollar-for-dollar match, a fixed “bonus” amount, or a hybrid of these. You define the rules and unlock triggers; we automate the rest behind the scenes.